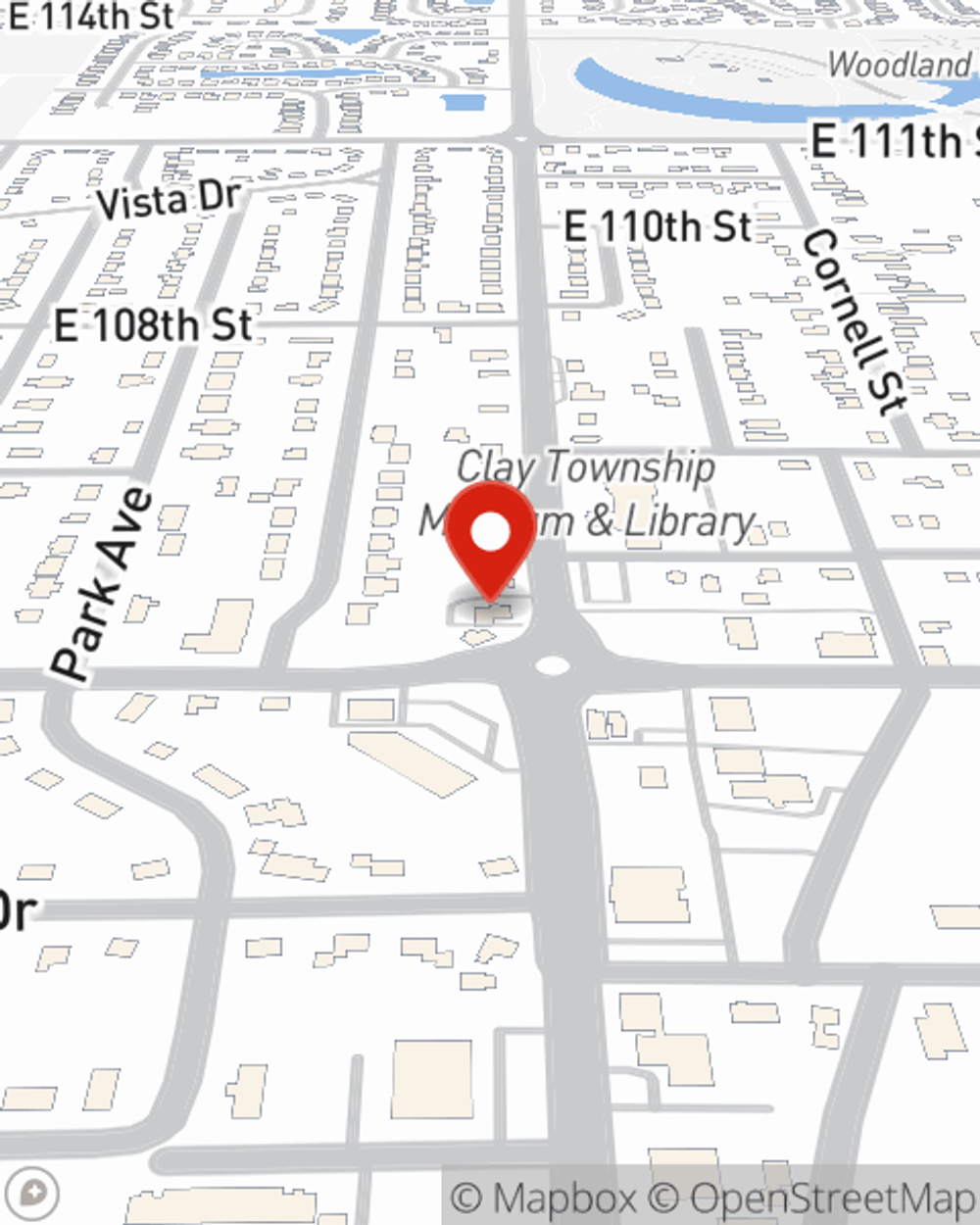

Condo Insurance in and around Carmel

Carmel! Look no further for condo insurance

Insure your condo with State Farm today

- Fishers

- Indianapolis

- Zionsville

- Noblesville

- Westfield

- Fort Wayne

- South Bend

- Bloomington

- Muncie

- Lafayette

- Anderson

- Greenwood

- Evansville

Home Is Where Your Condo Is

Because your condo is your retreat, there are some key details to consider - needed repairs, neighborhood, cosmetic fixes, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you excellent insurance options to help meet your needs.

Carmel! Look no further for condo insurance

Insure your condo with State Farm today

Condo Coverage Options To Fit Your Needs

Things do happen. Whether damage from hail, theft, or other causes, State Farm has wonderful options to help you protect your unit and personal property inside against unexpected circumstances. Agent Drew Federau would love to help you develop a policy that is personalized to your needs.

Finding the right insurance for your condominium is made painless with State Farm. There is no better time than today to contact agent Drew Federau and check out more about your great options.

Have More Questions About Condo Unitowners Insurance?

Call Drew at (317) 844-4900 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Drew Federau

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.